Charitable giving can be one of the most fulfilling ways to support causes that matter. Whether it's health research, disaster relief, veterans, or local food banks, the intention behind each donation is to make a difference. But in an era of growing online campaigns and nationwide solicitations, it’s more important than ever to understand where charitable dollars actually go—and how to ensure they’re being used responsibly.

This guide explains what to consider before donating to any charity in 2025. It includes tips on how to evaluate nonprofits, where donation funds typically go, and which tools and watchdogs help verify whether an organization is legitimate and effective.

For many individuals, especially those who have spent a lifetime working, saving, and supporting their communities, giving to charity is not just an act of kindness—it’s a legacy. Whether the goal is to support medical research, disaster relief, education, or veterans' services, donations can make a powerful impact when directed thoughtfully. But in a world where nonprofit organizations vary widely in transparency, effectiveness, and financial stewardship, it helps to pause before writing a check or clicking “donate.”

Today, the process of charitable giving involves more than just good intentions. With a growing number of online campaigns, email appeals, and phone solicitations, it’s easier than ever to give—but also easier to get misled. This is why understanding how to evaluate a charity, verify its legitimacy, and track how funds are used has become a crucial step in the giving process. The good news is that several trusted tools and resources now exist to help navigate these decisions with clarity and confidence.

Understanding the Charity Landscape in 2025

The U.S. nonprofit sector is robust, with more than 1.5 million registered charities, according to the National Center for Charitable Statistics [1]. While many of these groups provide meaningful impact, some have been criticized for high overhead costs, lack of transparency, or even fraudulent practices.

In 2024 alone, Americans donated approximately $557 billion to charitable causes—up 3.4% from the previous year, as reported by Giving USA [2]. While this generosity is inspiring, it underscores the importance of due diligence to ensure donations are truly going where intended.

Where Do Charitable Donations Actually Go?

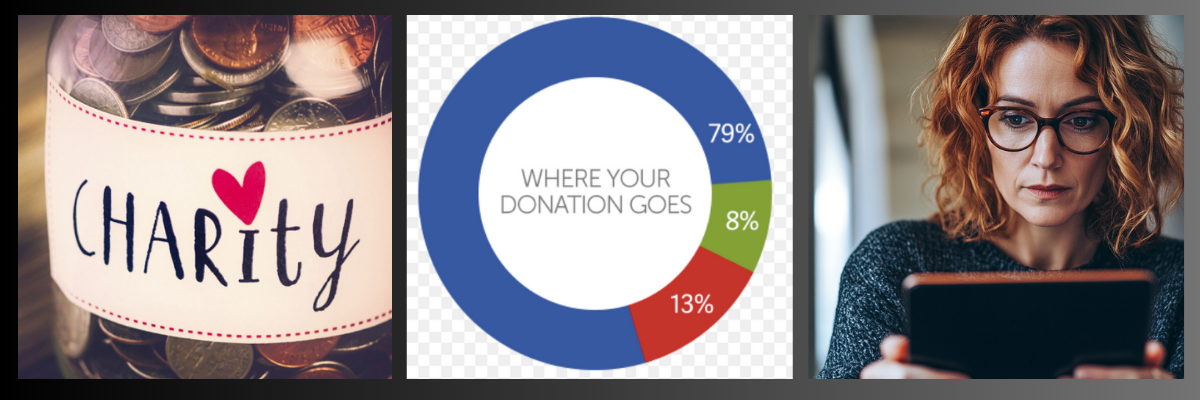

When someone donates to a charity, the funds typically fall into three main categories:

- Program Services (the cause itself)

- These funds go directly toward the charity’s mission—such as feeding the hungry or funding research. Reputable charities aim to spend at least 75% of their budget here.

- Administrative Costs

- These cover salaries, office space, and organizational management. While necessary, excessive administrative spending can signal inefficiency.

- Fundraising Expenses

- These include marketing, donor outreach, and events designed to generate more funding. Some large organizations spend over 20% of revenue on fundraising alone.

According to the Charity Navigator 2024 Sector Report, the average well-rated nonprofit spends 82% on programs, 10% on administrative costs, and 8% on fundraising [3].

“Transparency is key,” says Michael Thatcher, CEO of Charity Navigator. “A good charity explains how it uses donations—and backs it up with accessible financial data.” [4]

How to Evaluate a Charity Before Giving

Before donating, take the following steps to assess whether the organization is trustworthy and efficient:

1. Use Trusted Watchdog Sites

Sites like Charity Navigator, Candid/GuideStar, and CharityWatch rate nonprofits based on financial transparency, program impact, and spending practices.

2. Check IRS 501(c)(3) Status

Only organizations approved by the IRS as 501(c)(3) nonprofits are eligible to receive tax-deductible donations. Search the IRS Exempt Organizations Select Check Tool to confirm status.

3. Review the Charity’s Website

Look for:

- Mission clarity

- Financial reports or IRS Form 990

- Board of directors and leadership team

- Impact statements or annual reports

4. Watch for Red Flags

Avoid charities that:

- Pressure for immediate donations

- Lack financial transparency

- Don’t show clear mission outcomes

- Use emotional appeals without context

Key Questions to Ask Before Donating

- How much of each dollar goes directly to the program or service?

- Is the organization financially stable and transparent?

- Is it registered with state and federal agencies?

- Are there any recent controversies or warnings from watchdogs?

A little research can go a long way. In many cases, even highly rated charities differ in how they manage funds or focus their efforts.

Recent Trends in Charitable Giving (2024–2025)

- Rise of Local Giving: Donors are increasingly focusing on community-based nonprofits, especially after pandemic-era disruptions.

- Digital Donations: Over 60% of all giving now happens online, through websites, social platforms, and email campaigns [5].

- Donor Fatigue: Frequent donation requests, especially from email campaigns, have led to donor fatigue—making trust a critical factor in giving decisions.

“More than ever, people want to see proof,” says Laura MacDonald of the Giving USA Foundation. “It’s no longer just about the cause—it’s about confidence.” [6]

FAQs About Donating to Charities

Q: Are all nonprofits automatically reputable?

No. While many are well-run, others may mismanage funds or exaggerate impact. That’s why checking reviews and financials is essential.

Q: What’s a good ratio for spending on programs vs. overhead?

Experts suggest that 75% or more of donations should go directly to program services.

Q: Is it okay to give to new or small charities?

Yes—but review their mission, financials, and leadership. Small doesn’t mean ineffective, but transparency still matters.

Q: Can donations be claimed on taxes?

Only donations made to registered 501(c)(3) organizations are tax-deductible. Keep written documentation or receipts.

Q: What if a charity uses a third-party fundraiser?

Third-party fundraisers often keep a percentage of each donation—sometimes as high as 40%. Try donating directly through the charity’s website when possible.

Helpful Resources

- Charity Navigator – https://www.charitynavigator.org

- Candid (GuideStar) – https://www.guidestar.org

- CharityWatch – https://www.charitywatch.org

- IRS Tax Exempt Search – https://www.irs.gov/charities

- Better Business Bureau Wise Giving Alliance – https://www.give.org

Charitable giving is deeply personal—but it’s also a responsibility. Understanding where donations go, how charities operate, and what tools are available to verify claims makes giving safer and more rewarding. With a little research, it's possible to support meaningful causes and feel confident that each dollar is making the impact it’s meant to.

Citations

[1] National Center for Charitable Statistics, 2023

[2] Giving USA 2024 Annual Report

[3] Charity Navigator Sector Report, 2024

[4] Interview with Michael Thatcher, Charity Navigator, 2024

[5] Nonprofit Tech for Good: Digital Giving Trends Report, 2024

[6] Laura MacDonald, Giving USA Foundation Press Briefing, 2025

Disclaimer

This content is for educational purposes only and does not constitute financial or legal advice. Always research independently and consult with trusted advisors before making charitable contributions.